How to apply for this EIS

- Click on the Download button below to obtain all relevant literature.

- Read all the literature provided in full, ensuring you’re happy to proceed.

- Post the completed forms along with two valid forms of ID, and a cheque made payable to the provider, to: WealthMe, PO Box 362, Burgess Hill, West Sussex, RH15 5BH.

Free EIS Guide

Download our free & comprehensive guide to EIS. All investment decisions must be made solely on the fund's prospectus.

Fund title: Jenson EIS Fund 2023-2024 Tranche 3

Overview

WealthMe Arrangement Fee is paid by the product provider from the Initial commission.

Product charge - No initial fees charged to the Investor. Investment fee charged to the Investee Companies

Product information - provided by Jenson

The third tranche of the 2022/23 Fund is now open for investment and we will be looking to invest into a minimum of 5 companies from our existing portfolio. We aim to close the Fund on the 27 March 2023 with deployment planned within the 2022-2023, thereby allowing carry-back to the 2021-2022 tax year.

The Jenson EIS Fund was established in 2015 by Jenson Funding Partners (“JFP”) with the primary aim of supporting follow-on opportunities from its growing portfolio of SEIS companies.

A key part of the fund’s strategy is to target what JFP describes as the “EIS equity gap”, the stage between SEIS and later-stage EIS/Pre-Series A funding rounds. Companies at this point are typically just beginning to gain commercial traction and require funding and support to continue scaling the business.

To date, the Jenson EIS Funds have invested £4.7 million into 28 portfolio companies (all but one existing SEIS investments). The fund recently achieved its first exit, delivering returns across five out of eight funds ranging from 2.2x to 4.2x the gross investment costs (including performance fees and excluding the effects of any tax reliefs).

- Discretionary portfolio of 5-10 companies

- All investee companies are required to have HMRC Advance Assurance in place before investment is complete.

- The investments are expected to be completed in the 2022-2023 tax year.

- Performance fee - these fees are only payable once investors have received proceeds of at least £1.20 per £1 invested on an investment-by-investment basis. The Performance Fee in each investee company is calculated as 25% of distributions to Investors in excess of £1.20 per £1 invested. Plus VAT where applicable.

- Investee companies will be selected on the basis of an overall target exit consideration for the Fund of 300p for every 100p invested (after performance fees and before any tax relief) within four years to seven years.

Investment objectives - provided by Jenson

The Jenson EIS Fund has a mandate to focus on long-term capital growth and enables private investors to invest in a range of committed and ambitious entrepreneurs and their early stage growing companies. All companies will be small unquoted UK companies that qualify under the EIS tax rules. The Fund is a generalist fund, thereby the sector focus is agnostic and the type of businesses and opportunities can be anything that is EIS compliant (typically small early stage companies in non-capital intensive sectors). The specific focus of the Fund is to target companies with: strong management, momentum in the business (i.e. not pure start-ups) and low risk for a start-up (e.g. have a low cash burn). The EIS fund provides follow-on growth capital to our existing portfolio of S/EIS investee companies.

Jensons’ experience is that the EIS/VCT market is highly competitive in businesses that are typically generating £1 million of revenue and are seeking additional funding, which has the effect of driving up prices. As mentioned, Jenson has internal access to the existing SEIS portfolio of companies. Jenson therefore has access to companies that we have been working with for a number of years so are able to identify the most promising companies for follow on funding, additionally they are likely to fit the EIS criteria given the early stage of investment. We also receive many requests for funding from external companies and are therefore able to benchmark against these opportunities and also invest if we believe they provide a better opportunity. The key difference is that we will invest earlier than other EIS/VCT funds because of our close working relationships with our portfolio companies. This is higher risk than a traditional EIS/VCT and is reflected in the reduced valuations at which we typically invest.

In fact, it is this reputation of nurturing early stage businesses that has led to follow on investment/co-investment from many of the larger funds. From the existing portfolio, 25 have had at least one round of follow-on EIS funding from the Jenson EIS Fund, others from external providers. Nearly all of these rounds are externally led thereby validating the valuation of the companies which highlights that larger funds, family offices, VC’s and angel investors continue to invest in the companies we nurture to the next investment stage.

- Investment Criteria:

- Management team credibility

- Business and financial risks

- Business Momentum

- Business Concept and Strategy

- Equity deal and exit expectations

- In many circumstances, the investee companies are expected to have some similar key characteristics such as:

- Generating revenues or with a clear path to revenue generation;

- High growth potential with the possibility of realising a return multiple of at least five times on the Fund’s investment;

- Disruptive business models that can thrive in a recessionary environment whether by changing or enhancing a market;

- Evidence that a prospective investee company’s product or service is innovative and has market potential through testing or external;

- Addressing market gaps and brand lags – with unique and defendable propositions;

- Non-capital intensive business models that are both scalable and capital efficient; and

- Led by an inspiring, energetic and ambitious entrepreneur(s) capable of delivering the forecast investment returns.

When was your company established? - provided by Jenson

Jenson Funding Partners LLP was founded in 2012 when Seed EIS was introduced by law and the first Jenson Seed EIS Fund was launched in 2013. This fund closed over-subscribed at over £5 million and invested into 35 entrepreneurial UK businesses which had typically launched their product or service and were typically close to or post revenue. Since then, subsequent Funds have raised a further £11.6 million of SEIS investment and invested into a further 89 companies, 79 still active. We raised our first EIS Fund in 2015, to continue to support the best of the SEIS Fund combined with the best external investments that remain undervalued in the defined ‘equity gap’. Investment is made under one of two clear strategies. Firstly, to invest in companies that are still too early for traditional EIS/VCT funding and secondly to syndicate a larger round in collaboration with the larger funds.

How many staff do you employ? - provided by Jenson

There is a core team of 7 and 4 board members/advisers, the dedicated team perform the following roles CEO, CIO, Portfolio Management, Investor Relations, Dealflow Management, Marketing, Strategy and Business Development and Accounts, with other additional external team support where necessary

Please provide details on how many EIS/VCTs have exited and any performance figures - provided by Jenson

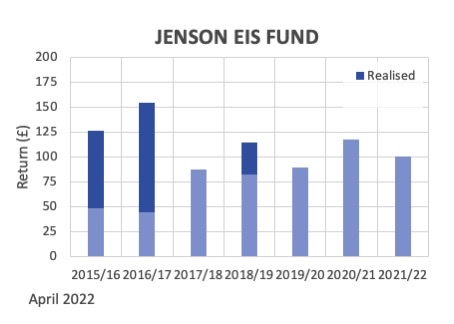

At present the majority of portfolio companies held in the EIS funds are within their three year hold period, however the Fund generated its first return when portfolio company Voneus was acquired by Macquarie Capital in February 2021. That acquisition provided returns ranging from 2.2x to 4.2x original investment (post performance fee and prior to tax reliefs) across several tranches of the EIS Fund.

Expected holding period - provided by Jenson

It is anticipated that most exits from Investments will take place after they have been held for between four years to seven years though some could take longer depending on market conditions and the nature of the investee companies. Jenson takes a long-term view on the Fund’s Investments and aims to only look at the possibility of exiting an investment after it has been held for at least three years, thereby ensuring that the investment has met one of the key qualifying conditions necessary for investors to obtain the tax reliefs. However, there may be occasions where an earlier sale is a commercially sensible decision.

Areas of potential investment interest - provided by Jenson

The Jenson EIS Fund is sector agnostic technology fund and focuses on innovative early stage high growth business with disruptive and defensible intellectual property which qualify for EIS Relief.

Details of products fully exited to date, eg, details of the returns made, ie above 100%, below 100% etc - provided by Jenson

Jenson has achieved nine exits across the SEIS and EIS funds with seven being cash returns and two being share returns. Seven of these returns were above par with 2 below par and ranges from 0.4x to 8.6x original investment. Overall the Jenson EIS Fund has returned in excess of £1m back to investors.

Jenson Performance fees - provided by Jenson

The Performance Fee on each investee company is calculated as 25% (plus VAT where applicable) of distributions to Investors in excess of £1.20 per £1 invested. These fees are only payable once investors have received proceeds of at least £1.20 per £1 invested on an investment-by-investment basis, to the extent, that the investor’s overall distributions from the Fund are in excess of 120% of the investors’ Net Subscription.

WARNING – Please read all product provider documentation and their website before proceeding.

We have provided the above information in good faith, however, it could be out of date or updated , therefore please always refer to the providers website for the most up to date information.

Fund type:

New Fund

Minimum investment

£10,000

Initial Charges

0%

Expected Close date

TBC

Funds Raised and sought

TBC of £5m

Rebate

0.00%

Important Information

The information given here has been taken from the product terms and conditions, brochure, and other

literature available from the product provider. However, no guarantee can be made to the accuracy of the

information. You should therefore satisfy yourself as to the full terms and risks of any investment by reference

to the relevant materials provided by the product provider. In the unlikely event of any discrepancy between

the information shown here and that provided in the provider literature, the product literature shall prevail.

All investment involves risk and you could lose some or all of the money you invest.